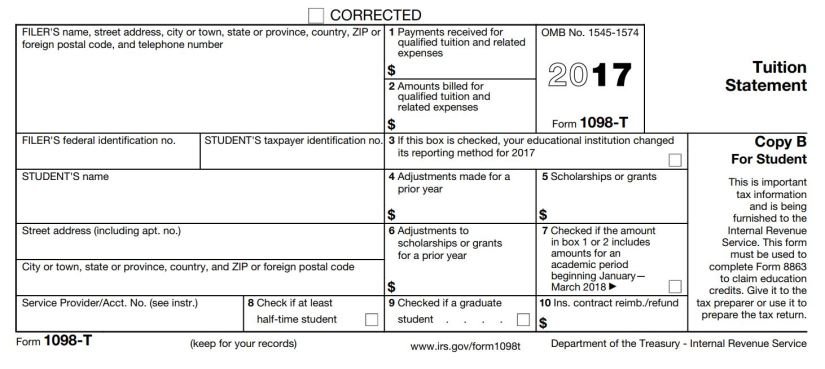

What’s a 1098-T?

If you have a college student, you (or they) probably received a form 1098-T. Schools are required to send this to any student who paid qualified higher education expenses. Here’s what you need to know about your 1098-T:

Who files it? If parents are taking either the AOTC or the LLC, then they file it. If the student had scholarships and/or 529 distributions in excess of qualified expenses, then the student should file it so that the excess is taxed to them. If the parents are not claiming any education tax credits, then they may not need to file the 1098-T. Read more from the IRS here and of course consult with your tax advisor about your specific situation.

Box 1 or Box 2? Schools can report either what was billed or what was paid for during the year. (Think of a December bill or payment for winter/spring tuition.) If they report what’s paid for, it’s in Box 1. If they report what’s billed, it’s in Box 2. If you are in the small portion of families that has exactly the right amount of 529 funds and cash flow payments for tax credits, and your school reports in Box 2, then you may need to watch out for discrepancies in the amounts and keep detailed records in the event of an audit. Again, consult your tax professional.

Box 5: This shows any scholarship amount. The difference between Box 1 and Box 5 is the amount for which you can either claim a tax credit or use 529 funds.

You’ll also receive a 1099-Q from your 529 plan if you withdrew any funds from it. As above, the amount on the 1099-Q should be less than Box 1 – Box 5 – $ amount claimed for tax credit. Any excess amount is taxable income to you.

Remember that the 1098-T will have your student’s Social Security number on it. Having 529 withdrawals sent to your student means that the 1099-Q will also have their Social Security number on it. This simplifies life considerably for IRS purposes because the 1099-Q can be automatically matched to the 1098-T.

See Saving for College Overview for more.